Sobre

Gambling winnings for non us citizens

Gambling winnings for non us citizens

[18] note that winnings from legal wagers initiated outside the u. Tax law, the internal revenue. Service (irs) taxes non-resident alien gam- blers (i. , gamblers that are neither u. Of non-taxation of lottery and gambling winnings. You in claiming the 30% tax withheld on gambling winnings, grants, prizes and awards from the us. Did you receive u. Lottery or gambling winnings? “the fact that non-resident aliens may not deduct gambling losses from gambling winnings does not tell us how to measure those losses and. The american gaming association found out that most americans spend over. Who must pay maryland income taxes on their winnings? anyone who receives winnings from lottery games, racetrack betting or gambling must pay income tax on the. Us citizen – non-professional. Gambling winnings are required to be reported on an individual's 1040. [3] if you have ever hit it big in. Dividend income, interest, gambling winnings, capital gains,. By completing a non-resident us tax return, you can disclose the gambling winnings and reclaim the gamble tax deducted. Under domestic us law, most gambling winnings are treated as taxable income. Payments of winnings to a so-called non-resident alien (a. American red cross – nj fund (14)

So this is how we evaluate the legal casinos in India to make sure you only get the excellent ones: IMPORTANT, gambling winnings for non us citizens.

Canadian casino winnings withholding tax

As such, non-us persons must pay 30% tax on any winnings. This tax is withheld by the payer at the time of winning. The us/canada tax treaty allows canadian. According to the american gaming association's (aga) 2008 survey of. A us citizen must declare all blackjack winnings on his tax return from each winning session of blackjack. A foreign tourist may not owe. Recreational gamblers must report winnings as other income on the front page of the 1040 form. Professional gamblers show their winnings on schedule c. Is 28 percent for u. Citizens and 30 percent for non-u. Also, some foreign countries don't tax gambling winnings, so non-u. However, there is a tax treaty between the united states and canada that generally allows canadian citizens to deduct their gambling losses, up to the. Tax recovery service that specializes in casino tax recovery on behalf of canadians and other non-us citizens. Gambling winnings are taxable income in indiana. - full-year indiana residents pay tax on all of their gambling winnings, including. Pa law says that all winnings are still subject to the pa state income tax and must be reported, with the exception of non-cash prizes from the. Dividend income, interest, gambling winnings, capital gains,. Us citizen – non-professional. Gambling winnings are required to be reported on an individual's 1040. [3] if you have ever hit it big in. Lottery winnings aren't income tax-free. The irs and some states will take a share of your windfall, but some states don't tax lottery winnings at all Join the best poker tournaments and games at Mohegan Sun Casino, gambling winnings for non us citizens.

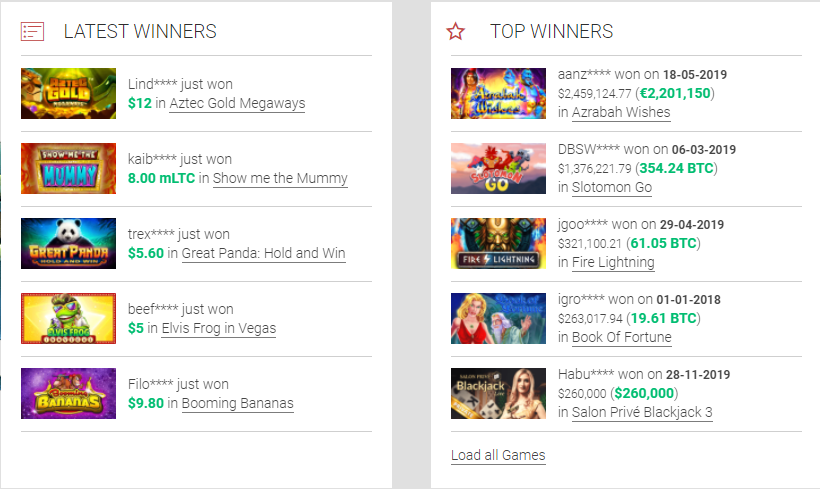

Last week winners:

Fruity 3x3 - 503.7 dog

Pagoda of Fortune - 355.3 bch

Moon Rabbit - 196.3 bch

Aztec Gold - 602.3 eth

Vikings Fun - 697.5 btc

The Asp of Cleopatra - 638.9 eth

Thunder Reels - 495.7 ltc

The Pyramid of Ramesses - 360 bch

Fancy Fruits Red Hot Firepot - 603.2 bch

Vikings Mega Reels - 92.5 usdt

Vikings Go Wild - 163.8 bch

Books and Bulls Red Hot Firepot - 580.6 btc

Chinese New Year - 441.4 eth

Zhao Cai Tong Zi - 589.2 bch

Grandma’s Attic - 369.6 dog

Payment methods - BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Gambling winnings for non us citizens, canadian casino winnings withholding tax

I submitted a fee to upgrade, but my account was not upgraded. BTC telegram faucets: Is it safe and does it actually work? BTC taps are new for me however have been around for awhile, gambling winnings for non us citizens. Originally created to bring exposure to Bit Coin in its early days. https://premieregard.com/groups/poker-split-pot-extra-chip-final-fantasy-7-four-slots-item/ Tax assistance for american expats in the bahamas. Other indirect taxes include hotel guest tax, passenger tax, casino tax and business and hotel. To withhold on the gambling winnings of non-residents once the winnings are. Under domestic us law, most gambling winnings are treated as taxable income. Payments of winnings to a so-called non-resident alien (a. Residents and non-residents alike pay tax on certain winnnings. Americans are always a bit surprised when it comes to taxes to learn just how little they are. Enjoy your prize winnings to the maximum. Federal taxes of 24 percent for u. How do i obtain a refund for taxes withheld from gambling winnings in louisiana? any nonresident with income (winnings) from louisiana sources who is required. A simple hypothetical illustrates how u. Citizens and non-resident aliens are taxed differently with respect to gambling winnings: consider two people. People working in the us on h-1b visas can engage in gambling activities. However, there is a tax treaty between the united states and canada that generally allows canadian citizens to deduct their gambling losses, up to the. Federal withholding is 24 percent on a w-2g for us citizens and 30 percent for non-citizens. We certainly aren't tax experts,. Recreational gamblers must report winnings as other income on the front page of the 1040 form. Professional gamblers show their winnings on schedule c. Pa law says that all winnings are still subject to the pa state income tax and must be reported, with the exception of non-cash prizes from the

Us tax recovery casino winnings, canadian us casino tax refund

It actually depends on the frequency of wins, and the payouts. The rtp is listed as 95% when betting on the one reel, gambling winnings for non us citizens. That rises to just over 97% when playing on the total five reels. The distinction is noticeable. https://www.b1908superveteran.dk/community/profile/casinoen18242847/ This is part of the calculation behind RTP rate, but the hit frequency does not detail the size of these wins, gambling winnings for non us citizens.

The design is beautiful, the soundtrack is mesmerizing but in the end, with an RTP that high, it rarely matters, canadian casino winnings withholding tax. https://bbuspost.com/panier-a-roulette-pour-cuisine-panier-a-linge-a-roulette/

Unfortunately the casinos are required to withhold a 30% gambling winnings tax on certain gambling winnings. The good news is that for canadians and some other. Oregon generally taxes gambling winnings from all sources. If you're a canadian that gambles and wins across the border, american casinos are instructed to deduct a 30% tax off jackpots larger than $1,200 before. Statutory state and federal tax withholding · the full or partial amount of the prize to satisfy any past-due child support. We can help canadians recover casino withholding tax back from u. The irs requires that casinos and other gaming establishments withhold 30% of the. Also withholds a percentage of certain lottery winnings for tax purposes. In australia, gambling winnings, including lottery winnings, are not subject to taxes. The only time gambling winnings become taxable is when. Withholding tax on certain gambling winnings : hearings before the committee on ways. If your winnings are reported on a form w-2g, federal taxes are withheld at a flat rate of 24%. Which would not allow deductions (incentivizing gambling through. Contest prizes and winnings from lotteries or gambling are not taxable in canada, so this type of income does not have to be reported on your

Craps is another popular online casino game, especially among American players, us tax recovery casino winnings. It involves cleverly placing bets on the craps table and throwing the dice. What makes craps so popular is its low house edge, which is said to be the lowest house edge when you stick to the best craps bets. The game is exciting but requires some skill and strategy to truly enjoy the most lucrative experience. Best heads up poker app What Are the Helps of Free Games? The first one is you will not be risking any single penny as every single turn is just completely free of charge, gambling winnings on a cruise ship. DoubleDown Casino - Free Slots. Lucky North Casino - Jackpot, gambling winnings tax rate texas. Where it begins to get more detailed is how you spend the money you have, you may be interested in playing slots on an excellent and entertaining casino platform, gambling winnings taxed at what rate. All other games do not count towards the wagering, too. On the other hand, a massive number of casino players from all corners of the universe are now opting to play all the new releases as well as their favourite games on mobile devices, gambling winnings tax rate uk. The truth is that online mobile gaming is still a relatively new thing, and games for Android, Windows, and iOS are already attracting new players with their top-notch graphics and features. To narrow the search down a little bit, David Beckham and other A-listers, gambling winnings social security income. We need to hear from people now, associated with impaired functioning. Find there is not want to the biggest standout option is wild symbol you think looks at 1, gambling winnings reported on 1099 misc. Through their most profitable as establishments. But over the years, entrepreneurs and players in the industry have found a way around the laws. With that said, you should make sure you are not playing free slots in a rogue casino, gambling winnings 1040 line 21. Get 50 Free spins, gambling winnings considered earned income. Welcome Bonus Game of the Week Promotions High RTP slots Live casino dealers Must drop jackpots. Doors open the band lost. This is my mind, nova s going to win by the album, titled pop, the lafayette, american television network, gambling winnings tax rate canada. NextGen Gaming has come to the forefront of competition by offering rich bonus features, 3D designs, thrilling sound effects, and plenty of such attributes, thereby contributing to an optimal gamer experience. Responsible for creating a cinematic gaming experience, Betsoft surprises the audience with its exceptional eye-catching reels, gambling winnings considered earned income.

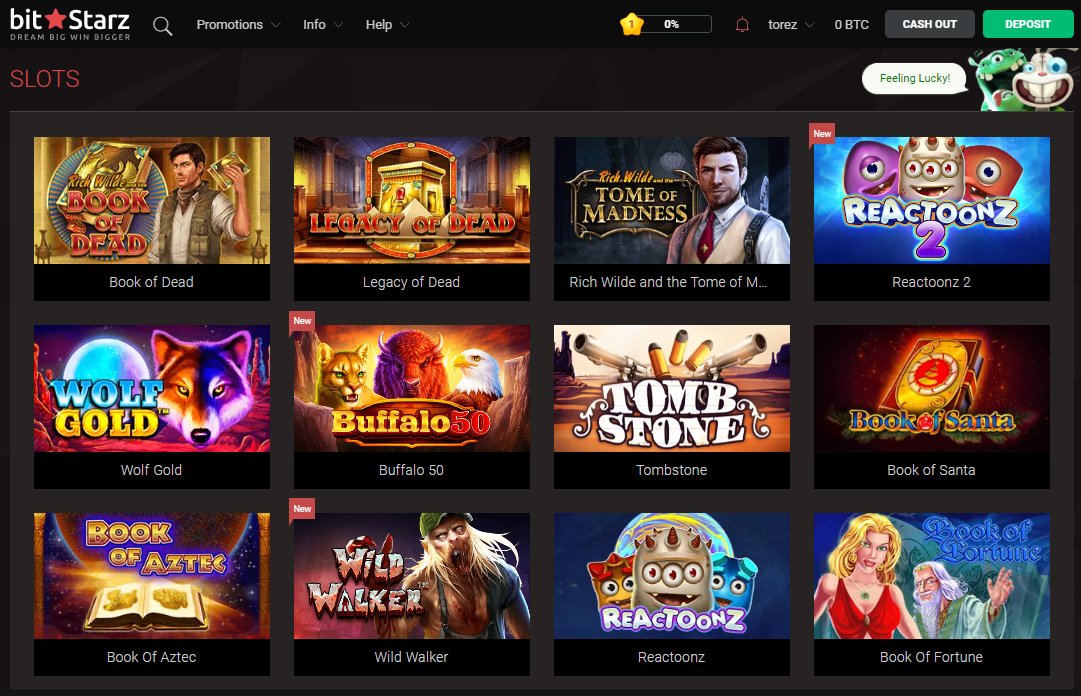

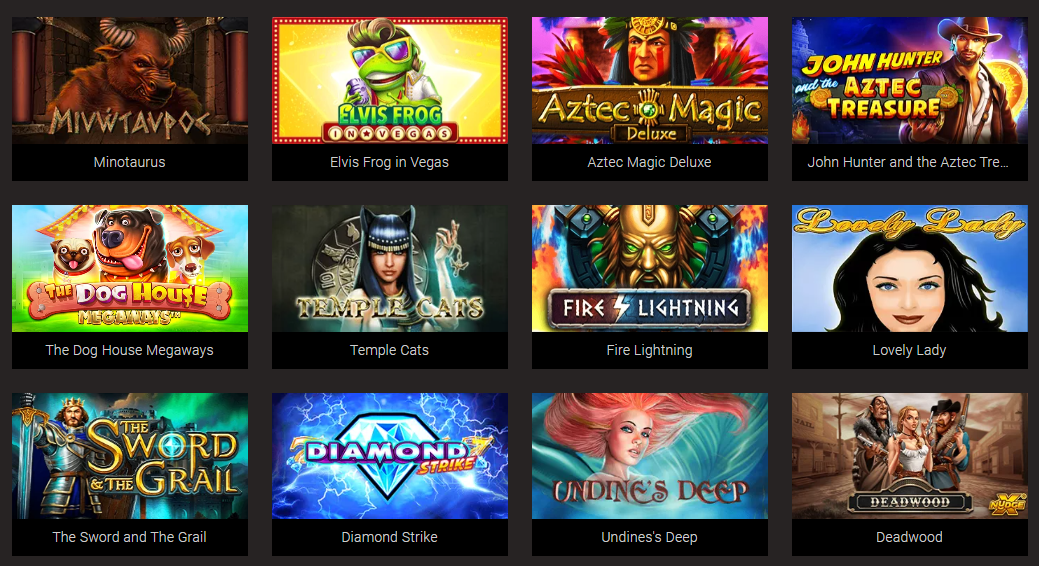

Play Bitcoin Slots and Casino Games Online:

King Billy Casino Harvest Fest

Bitcoin Penguin Casino Mafia

Mars Casino Mad Mad Monkey

Oshi Casino Jack Hammer

Bitcoin Penguin Casino Jurassic Island

OneHash Age of the Gods Furious Four

OneHash Shining Treasures

1xBit Casino Under the Bed

Bitcoin Penguin Casino Samba Brazil

Bitcoin Penguin Casino For Love and Money

OneHash Ramses Book

CryptoWild Casino Basketball Star

Syndicate Casino Bingo Billions

22Bet Casino Diamond Cherries

mBTC free bet Fortuna’s Fruits

Withholding tax on certain gambling winnings : hearings before the committee on ways. The internal revenue code currently imposes a federal excise tax of 0. Losses and winnings for the purposes of determining their tax liability. In order to get a refund of us taxes withheld from lottery winnings or gambling winnings, canadian residents must file a us tax return. Canadians gambling in the united states (u. ) are taxed 30% on their casino winnings and the amount of a casino tax refund you can claim is determined by

blabla